Division of Property After Divorce in India

Introduction

Navigating the end of a marriage is never easy. Alongside emotional upheaval, addressing the division of property after divorce often becomes a major concern. In India, courts follow well-established personal laws and judicial precedents to achieve fair property distribution after divorce in India, balancing emotional welfare with financial equity. This guide aims to provide empathetic insights and professional clarity on divorce property division, ensuring you feel supported and informed throughout the process.

Legal Framework for Division of Property After Divorce

Before initiating property division proceedings, it’s essential to understand the statutory provisions and judicial precedents that shape how assets are allocated. This section outlines the primary laws and guiding principles courts rely on to ensure equitable distribution.

Overview of Personal Laws

Property distribution after divorce in India hinges primarily on which personal law applies:

- Hindu Marriage Act, 1955: Sections 23–25 empower family courts to adjust property rights and grant maintenance, including commands for transfer or sale of assets (India Code, Legislative Department ).

- Special Marriage Act, 1954: Extends similar property division principles to couples married outside traditional religion-based ceremonies, ensuring secular equity.

- Muslim Personal Law (Shariat) Application Act: Lacks formal community property notions but recognizes husband’s and wife’s rights to maintenance and dower (mehr).

- Christian Laws & Parsi Laws: Generally follow common law principles and rely on maintenance petitions under the Divorce Act or family court jurisdiction.

Role of Judicial Discretion

No two divorces are identical. Indian judiciary often exercises discretion based on:

- Spousal Needs: Age, health, income capacity, and lifestyle adjustments.

- Child Welfare: Future education, housing, and healthcare.

- Duration of Marriage: Longer marriages may justify larger settlement shares.

- Contributions: Financial and non-financial contributions, including homemaking and caregiving.

Courts may endorse lump-sum payments, property transfers, or structured maintenance orders to reflect these factors.

Types of Property Considered in Division

This section explores different categories of assets that qualify as marital versus separate property and highlights typical assets that are evaluated during the division of property after divorce to ensure a fair and equitable process.

Classification of Assets

Understanding property categories helps streamline divorce property division:

- Marital Assets: Jointly acquired real estate, shared investments, retirement benefits, or business equity earned during marriage.

- Separate Assets: Inherited property, personal gifts, pre-marriage holdings, and assets acquired using separate funds.

Examples of Common Assets

Below is a snapshot of assets most commonly evaluated during property division after divorce:

- Real Estate: Residential homes, agricultural land, commercial premises.

- Financial Instruments: Fixed deposits, mutual funds, stocks, bonds, retirement savings.

- Business Interests: Ownership stakes, partnership shares, professional goodwill.

- Personal Belongings: Vehicles, household appliances, jewelry, artworks.

Quantifying and classifying these assets accurately is critical for equitable distribution.

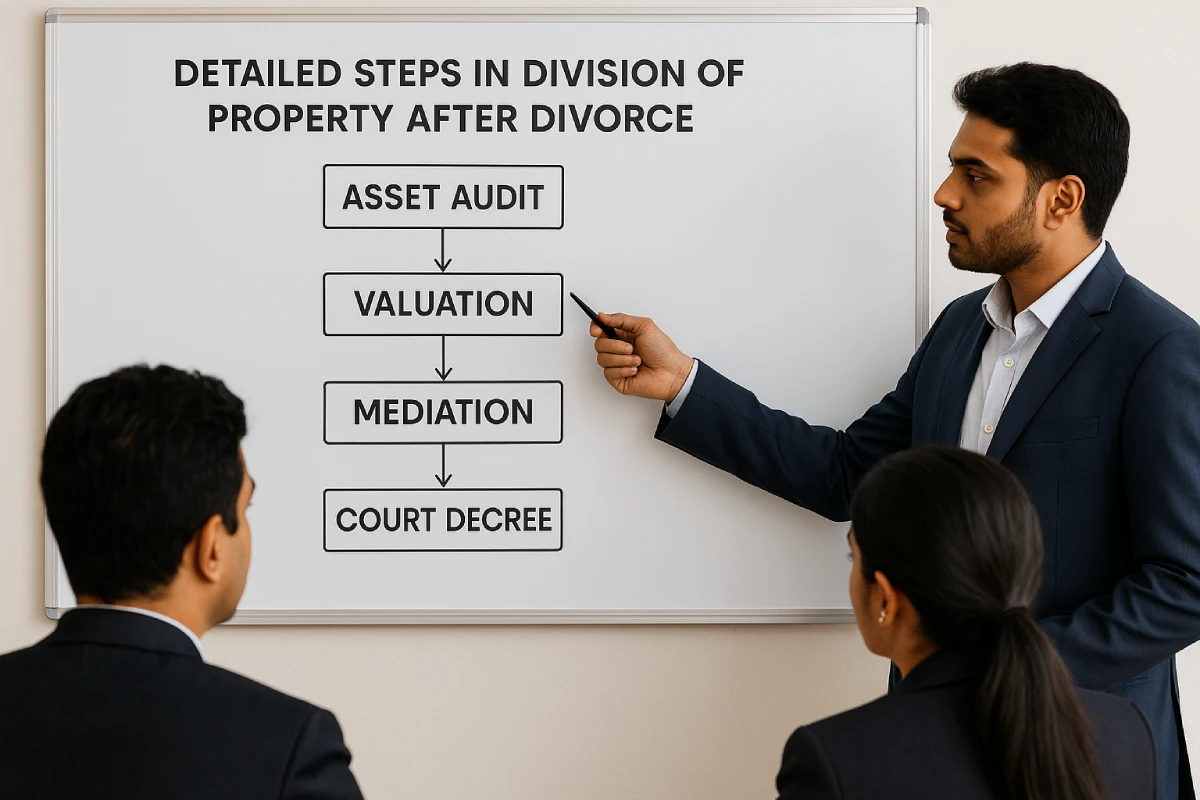

Detailed Steps in Division of Property After Divorce

The property division process follows a structured sequence to ensure all assets are accounted for and distributed fairly. Below is a step-by-step overview describing how courts and parties typically proceed from asset review through implementation of the final decree.

- Comprehensive Asset Audit

- Create a master inventory of movable and immovable assets.

- Include supporting documents: title deeds, purchase receipts, bank statements, investment portfolios.

- Executive summary of debts and liabilities (loans, credit card dues).

- Professional Valuation

- Engage real estate valuers for property, chartered accountants for business interests.

- Confirm market rates, fair market value assessments, and depreciation considerations.

- Legal Documentation and Evidence Gathering

- Assemble property titles, gift deeds, wills, and mutation certificates.

- Collect digital records: email trails, bank e-statements, mutual fund statements.

- Affidavits and notarized declarations were necessary.

- Negotiation, Mediation & Alternate Dispute Resolution

- Family courts often mandate mediation sessions as a first recourse.

- Professional mediators help draft a mutually acceptable property settlement agreement.

- If mediation stalls, consider arbitration clauses or collaborative law models.

- Formal Court Proceedings (if settlement fails)

- File petitions under relevant personal law sections, with clear property claims.

- Court-assisted conciliation hearings to minimize contention.

- Final hearing where evidence is presented, and courtroom negotiations refine settlement terms.

- Final Decree and Implementation

- The court issues a decree detailing property transfers, lump-sum payments, and maintenance orders.

- Registration of property transfers in the local sub-registrar’s office; updating mutation records.

- Periodic reviews of maintenance orders were allowable.

Practical Tips for Division of Property After Divorce

Practical, actionable advice can help streamline negotiations, minimize disputes, and ensure assets are allocated fairly. Here are the key best practices to follow.

- Engage Experts Early: Valuers, forensic accountants, and legal counsel streamline disputes.

- Maintain Financial Transparency: Full disclosure during property distribution after divorce prevents disputes and accusations of concealment.

- Leverage Mediated Settlements: Faster resolution, cost-effective, preserves relationships.

- Plan for Tax Liabilities: Stamp duty, registration fees, and capital gains tax implications on asset transfers.

- Consider Long-Term Security: Emphasize assets that provide ongoing income, especially where child support is concerned.

- Protect Privacy: Use confidentiality clauses in settlement agreements to protect sensitive financial data.

FAQs

What is the typical timeframe for dividing property?

Most cases resolve alongside the final divorce decree, about 6–12 months. Complex valuations or contested assets may extend timelines to 18–24 months.

Can ancestral property be part of the settlement?

Ancestral property usually remains with the original heir. However, courts may include their income or usage rights in maintenance calculations under Section 24 of, Hindu Marriage Act.

How are business shares and professional goodwill valued?

Independent chartered accountants issue valuation reports based on revenue, goodwill multipliers, and industry benchmarks. Disputes are often resolved via buy-out clauses or share transfers.

Is mediation mandatory before litigation?

Family courts refer parties to mediation first, but if one spouse opts out or if no progress is made, courts can waive further mediation and proceed with hearings.

Do prenuptial agreements hold weight in Indian courts?

Prenuptial agreements have no statutory backing in India. However, fair prenups can influence settlement talks if they reflect equitable, informed consent.

How are debts allocated?

Courts assess each spouse’s liability capacity. Joint debts may be split equitably or reassigned entirely based on earning potential.

Can property settlements be modified later?

Maintenance orders can be reviewed if there’s a significant change in circumstances, but property transfers finalized in decrees are generally irreversible.

Can a husband claim a wife’s property during divorce in India?

Generally, a husband cannot claim a wife’s separate property (like inherited or gifted assets). However, he may receive a share of marital assets acquired during the marriage through the division of property after divorce.

Can a wife claim her husband’s property during divorce?

Yes, a wife can claim a fair share of marital assets under the Hindu Marriage Act or relevant personal laws. Separate assets owned before marriage typically remain exempt from property distribution after divorce.

Contact Us for the Division of Property After Divorce

Facing challenges in the division of property after divorce? Reach out to Prashastha Legal for compassionate and expert support. Book your consultation with our divorce lawyers in Bangalore now and take control of your future with confidence.